WFA study ranks countries by programmatic maturity

Advertisers need to tailor approach according to market development

Share this post

WFA and Infectious Media have compiled a unique study into the level of local programmatic maturity around the world, breaking down 13 of the world’s biggest ad markets into four clusters depending on their sophistication.

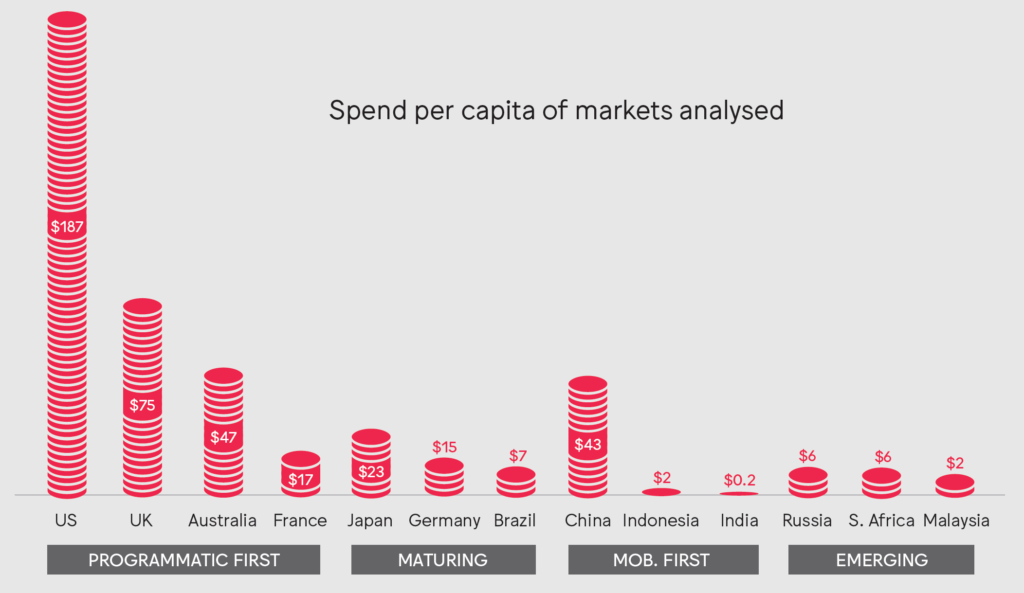

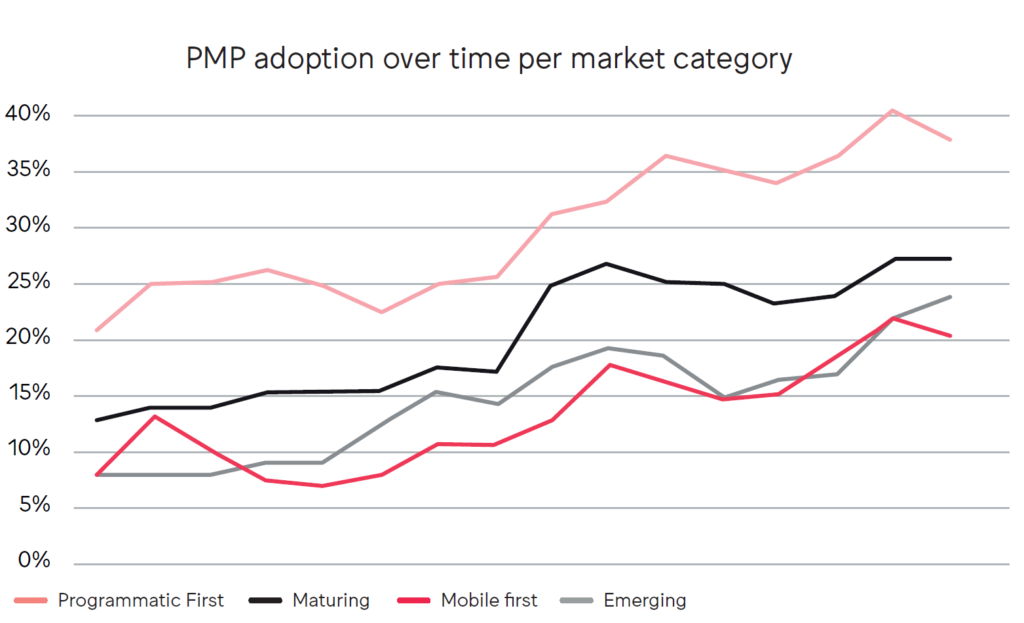

Based on analysis of key factors such as spend per capita, private marketplace (PMP) penetration and the prevalence of key inventory types, the WFA has divided up markets into four categories; Programmatic First Markets, Maturing Markets, Mobile First Markets and Emerging Programmatic Markets.

- Programmatic First Markets: US, UK, France and Australia

- Maturing Markets: Germany, Japan and Brazil

- Mobile First Markets: China, Indonesia and India

- Emerging Markets: Russia, South Africa and Malaysia

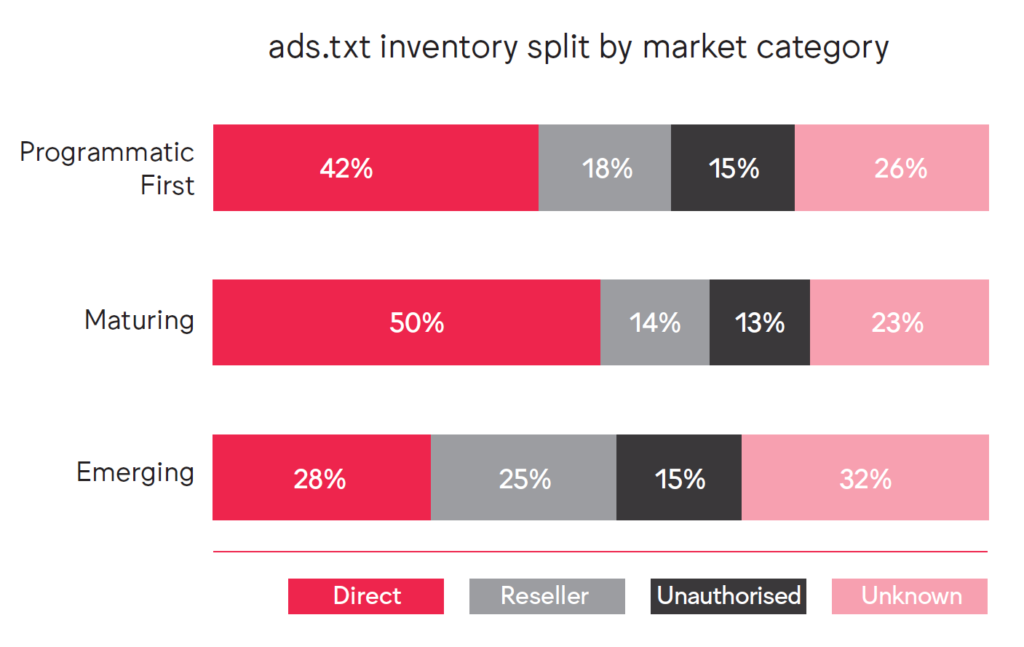

The classification is based on data from both the demand and supply sides of the ecosystem and takes into account programmatic video availability, the level of implementation of ads.txt and the volume of direct publisher to SSP relationships.

These classifications are vitally important because they affect how brands should approach their digital media strategy in each type of market, the best way to access inventory, the level of transparency that’s likely to be on offer and how to avoid excessive exposure to ad fraud.

The report identifies that Programmatic First Markets, such as the US, UK, France and Australia, are chiefly characterised by the fact that most inventory sources are accessible programmatically, providing scaled access to premium video inventory, often in a flexible and transparent commercial model. It’s recommended that advertisers demand high viewability, fully disclosed trading and a high level of data access.

PMPs, a symptom of more sophisticated trading, represent around 40% of all inventory in Programmatic First Markets, around double that of Emerging or Mobile First Markets. While PMPs may be associated with higher CPMs, they represent access to higher quality inventory and unique publisher second-party data both of which are core areas of focus for WFA members.

In contrast to Programmatic First Markets, most inventory and formats in Maturing Markets (such as Germany, Japan and Brazil), will be available via programmatic, but access will be less automated. In these markets, factors such as legacy trading relationships and/or technological separation from the global ad tech ecosystem, has suppressed maturity. It’s recommended that advertisers consider visiting these markets to establish direct relationships with publishers.

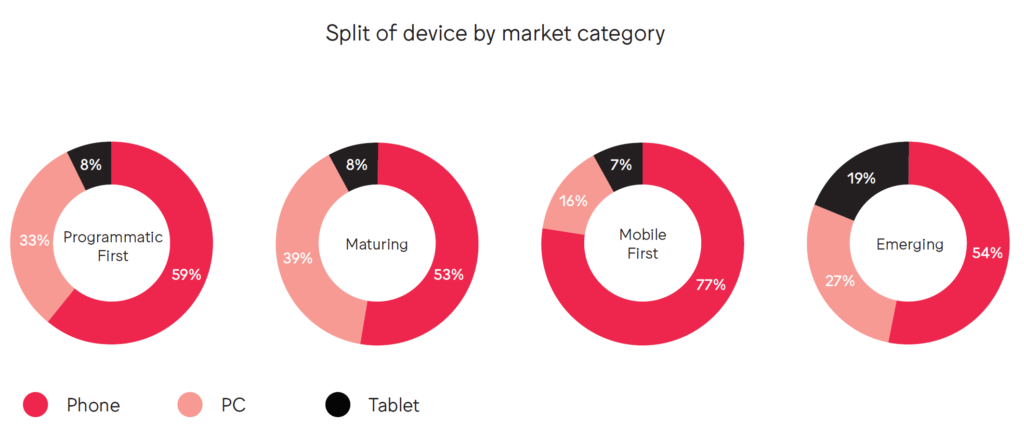

As more of the media landscape moves to mobile, it could be argued that most markets will end up in the Mobile First bracket. But as more local media companies began in app environments in markets such as China, Indonesia and India, they need to be considered distinct from other countries included in this study. This is not a migration to mobile, but a continued evolution in the way the device has been used by consumers and advertisers. A solid solution for capturing and reporting on device IDs in these markets is critical.

Emerging Programmatic Markets are not as digitised as the others included in this report, however, the economic potential of large population sizes makes markets such as Russia, South Africa and Malaysia a compelling advertising opportunity. The universe of internet users in Russia, for example, is almost 80% larger than the UK (a Programmatic First Market), but programmatic spend per capita is a fraction of the UK’s. Suppliers in these markets are often entering programmatic from traditional trading, meaning legacy trading practices persist. Transparency can be a problem and focused attention on scope and contracting is recommended.

The WFA and Infectious Media plan to update this analysis annually, incorporating more datasets including fraud penetration level and data relating to supply path and local auction dynamics.

"Media buying is, ultimately, a local business and demands a local approach. But there are considerable opportunities to consolidate and simplify this, avoiding the need for a unique programmatic stack per market. ‘Media transformation’ is the focus for many WFA members and this report supports that ambition, helping marketers to define their global programmatic strategy with local executional tactics,” said Matt Green, Global Media Lead, WFA.

It’s become increasingly common for WFA members to develop their own tech stacks, contracting directly with Demands Side Platform partners, Data Management Platform partners, Ad Serving partners, and others. The Global Programmatic Market Maturity Report gives global marketers the insight they need to adopt a technology approach that can be underpinned by a global framework while also having scope for local adjustment.

"Many of us at leading brands and agencies spend a significant amount of time investing in our tech and buying infrastructure, however these efforts – and the discussions we have as an industry – are overwhelmingly US and Western-Europe centric. For a global marketer like EA, which operates in more than 30 countries around the world, it’s imperative to have an informed understanding of how solutions built for mature markets may or may not be operable in other parts of the world. The data in this report helps us inform our operations and infrastructure at the local and regional levels,” said Belinda Smith, Global Head of Media, Electronic Arts.

"We didn't know of any subjective programmatic maturity research based on a consistent framework across markets. So we saw the opportunity to use the data from billions of auctions that take place globally to fill this gap. The resulting report has produced many surprises, even considering our good understanding of these markets through our buying for clients. This has led to important insights into how advertisers need to tailor their programmatic strategy across countries," said Dan Larden, Global Partnerships Director, Infectious Media

For more information and to download the report visit: www.wfanet.org/programmaticmaturity