Outlook 2017: crunching the numbers in media

There will be fewer major sporting events in 2017 than we’ve seen this year.

Share this post

And with the US election and ‘Brexit’ out of the way, there are fewer political events to support ad spend in 2017. But the market is still widely tipped to come in at around +4% globally - similar to 2016.This number paints a rosy picture, but digging deeper reveals some stark differences in ad spend growth by market. Zenith characterise the group of markets driving greatest global growth as ‘Fast-track Asia’ (China, India, Indonesia, Philippines, etc) – delivering +8% in ad spend growth in 2017. The drop in oil prices for the MENA region, meanwhile, has prompted advertisers to cut back budgets in anticipation of lower consumer demand.

Much regional and local nuance can also be found within OUTLOOK2017, WFA’s annual examination of media cost forecasts. This is a project contributed to by ten media agencies and media auditors and which covers 46 markets across seven media channels.

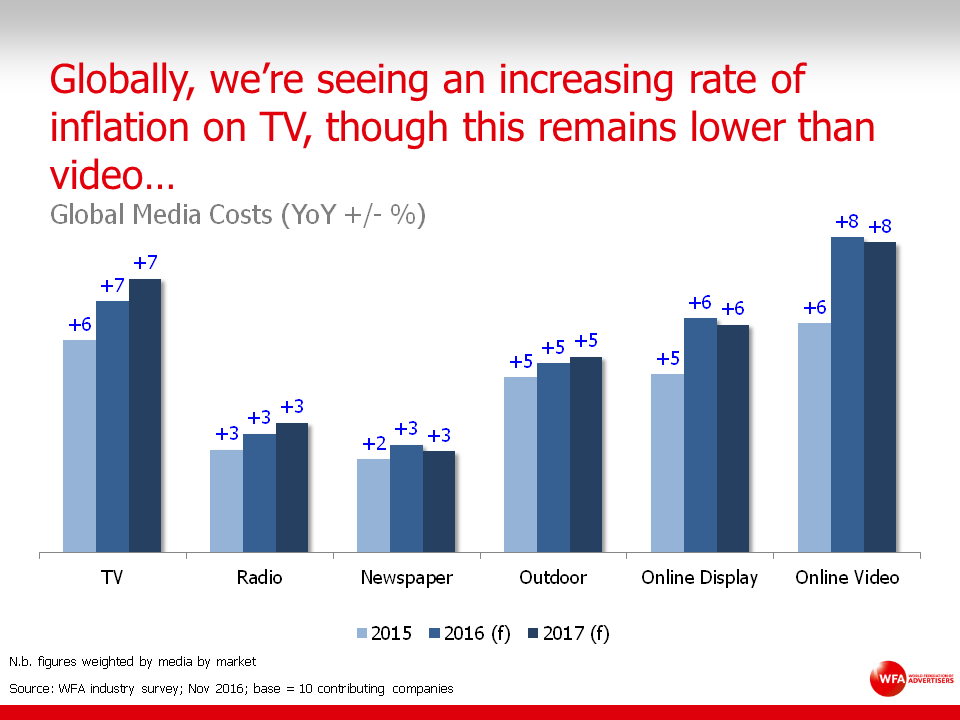

Globally, we’re seeing an increasing (weighted average) rate of inflation of TV to +7.2% (vs +6.6% in 2016). But interrogating this by region reveals some contrasting trends. Much of the TV inflation is coming from the Americas at +8.4%. In contrast this is +4% in EMEA.

It’s not unusual to see hyper-inflation in some Latin American markets. Venezuela is expected to be up +242% in 2017, and while this sounds high, the IMF have predicted the economic rate of inflation to be above 1,500% next year, making TV’s level appear fairly modest.

The US represents almost 80% of the Americas’ TV market, and with +6.9% price inflation forecasted for 2017, this market is dictating what we’re seeing at a regional level. Interestingly, TV is predicted to inflate well ahead of any other media in the US, linked to a particularly strong Upfront season, but it’s also said that advertisers are redistributing budgets back to TV following increased scrutiny and concern over the level of fraud, transparency and measurability in digital. Just last week we saw Marcos De Quinto, The Coca-Cola Company’s CMO, defend TV for its superior ROI.

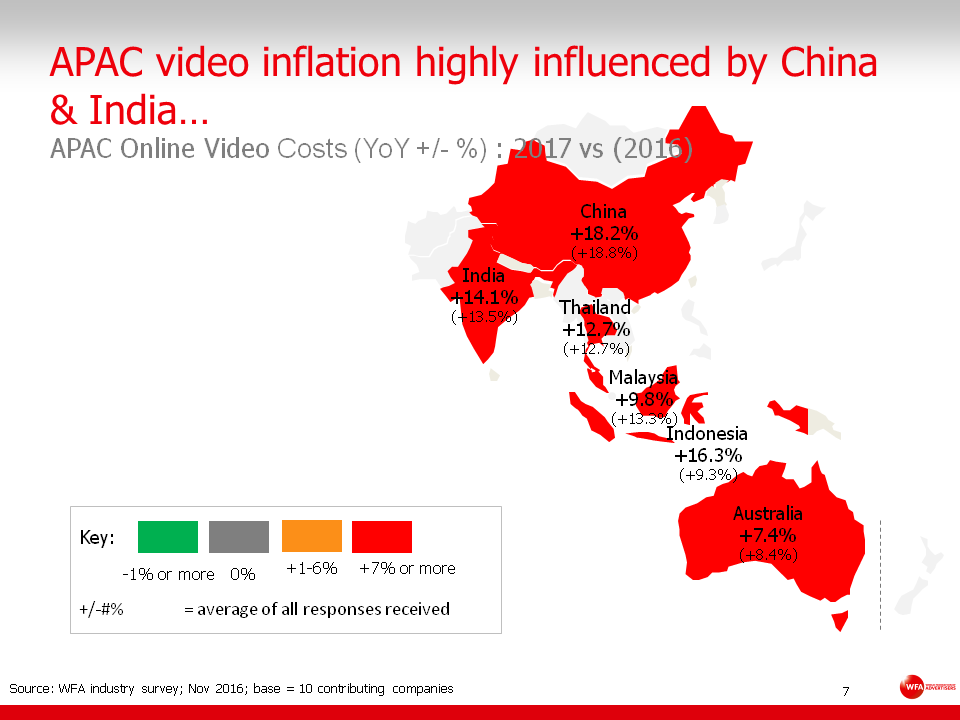

Zooming back out to look at the global picture, it’s noteworthy that online video is projected to be the most inflationary medium in 2017. This is predictable enough given the level of demand for the channel. But breaking down this number by regions reveals that much of this is being driven by Asia-Pacific, with 14.2% price inflation anticipated for the region, compared to just +4.3% in EMEA.

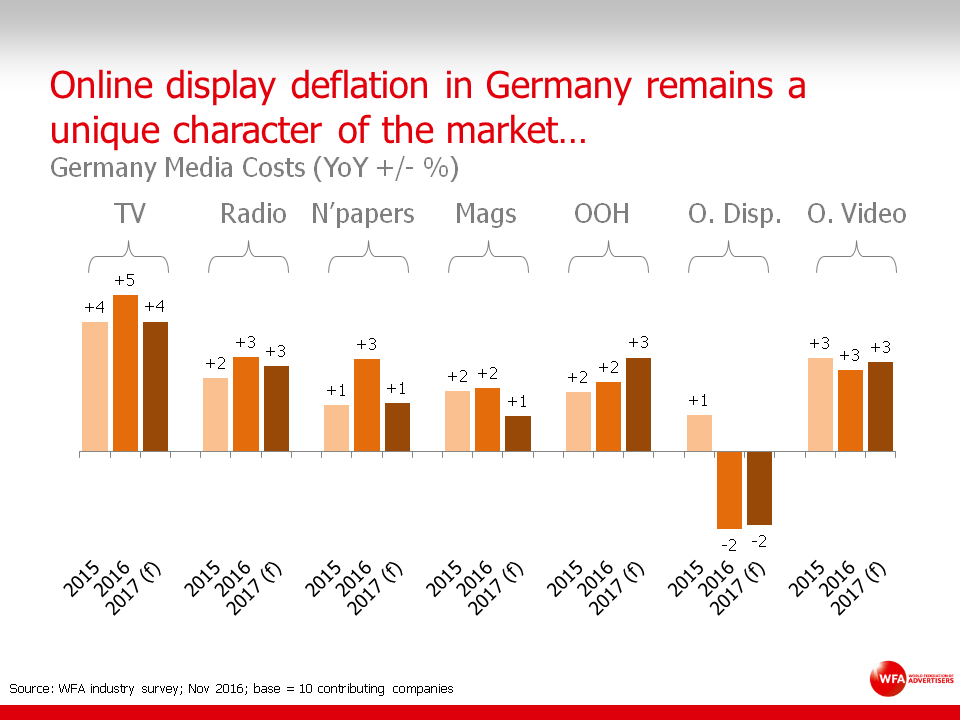

Video price inflation in China is projected to hit +18.2% in 2017, and as the powerhouse in the region, this is dictating what we’re seeing across APAC. Video has been on an extraordinary growth path in China, with ad spend growth of around +30% in 2016 and +20% in 2017, this is rivalled only by mobile (source: Zenith). This level of demand appears to be driving prices to new highs. You might be forgiven for thinking that everything is on the up, but we are seeing some deflation. In Germany, online display prices are set to fall (by 2%) for the second year running. Meanwhile, newspapers and magazines have been experiencing price deflation for a number of years, linked to the inexorable decline of readerships.

You might be forgiven for thinking that everything is on the up, but we are seeing some deflation. In Germany, online display prices are set to fall (by 2%) for the second year running. Meanwhile, newspapers and magazines have been experiencing price deflation for a number of years, linked to the inexorable decline of readerships.

Ultimately the market is demonstrating a preference for video (whether on TV or digital), and as it stands demand is exceeding supply (of quality inventory). In a sign of things to come, Facebook have just announced that they are dipping their toes into original and licensed video. It seems sensible to suggest that more media owners will pivot in this direction in 2017 and beyond.