Get analysis, insight & opinions from the world's top marketers.

Sign up to our newsletter.

Investment down in all channels, with TV suffering a 33% fall

Crisis accelerates change in the way marketing organisations operate

Full report available for download here.

Large multinationals are likely to cut harder and hold back ad spending for longer, according to the latest WFA Covid-19 Response Tracker.

The second wave of the research found that 89% have deferred campaigns, up from 81% in March, with delays likely to last much longer than previously planned. Fifty-two percent of large multinationals surveyed will now hold back ad spend for six months or more, compared to just 19% taking similar medium-term action in March.

While 68% have some kind of crisis response campaign now running (up from 32% in March), this activity will not compensate for the cuts to other campaigns. Global ad budgets are now expected to be down 36% in the first half of the year (up from 23% in Wave I) and 31% for the full year.

Wave II was conducted in the last full week of April and attracted responses from senior marketers in 38 companies across 17 sectors with a total annual global spend of $46 billion. Sixty-one percent of respondents held global positions with 39% in regional roles.

While 62% of respondents agree that it’s critical for brands not “to go dark” during the crisis, they are still making dramatic cuts to spend overall. The squeeze is being felt hard by TV, traditionally the biggest media channel and expected to be down 33% globally across the first half of the year, although print (down 37%), out of home (down 49% and events (down 56%) are suffering more.

Digital is boosting its share of ad spend by virtue of the fact that spend falls in this area are less dramatic, with online video down 7% and online display down 14%. Other channels such as Radio (-25%), Point of Sale (-23%) and Influencer (-22%) are expected to experience significant cuts.

While global marketing teams are taking drastic action on the number of ads seen by their target consumer audiences, they are also viewing the situation as an opportunity to make radical changes to the way they operate as marketing organisations both internally and in partnership with their agencies.

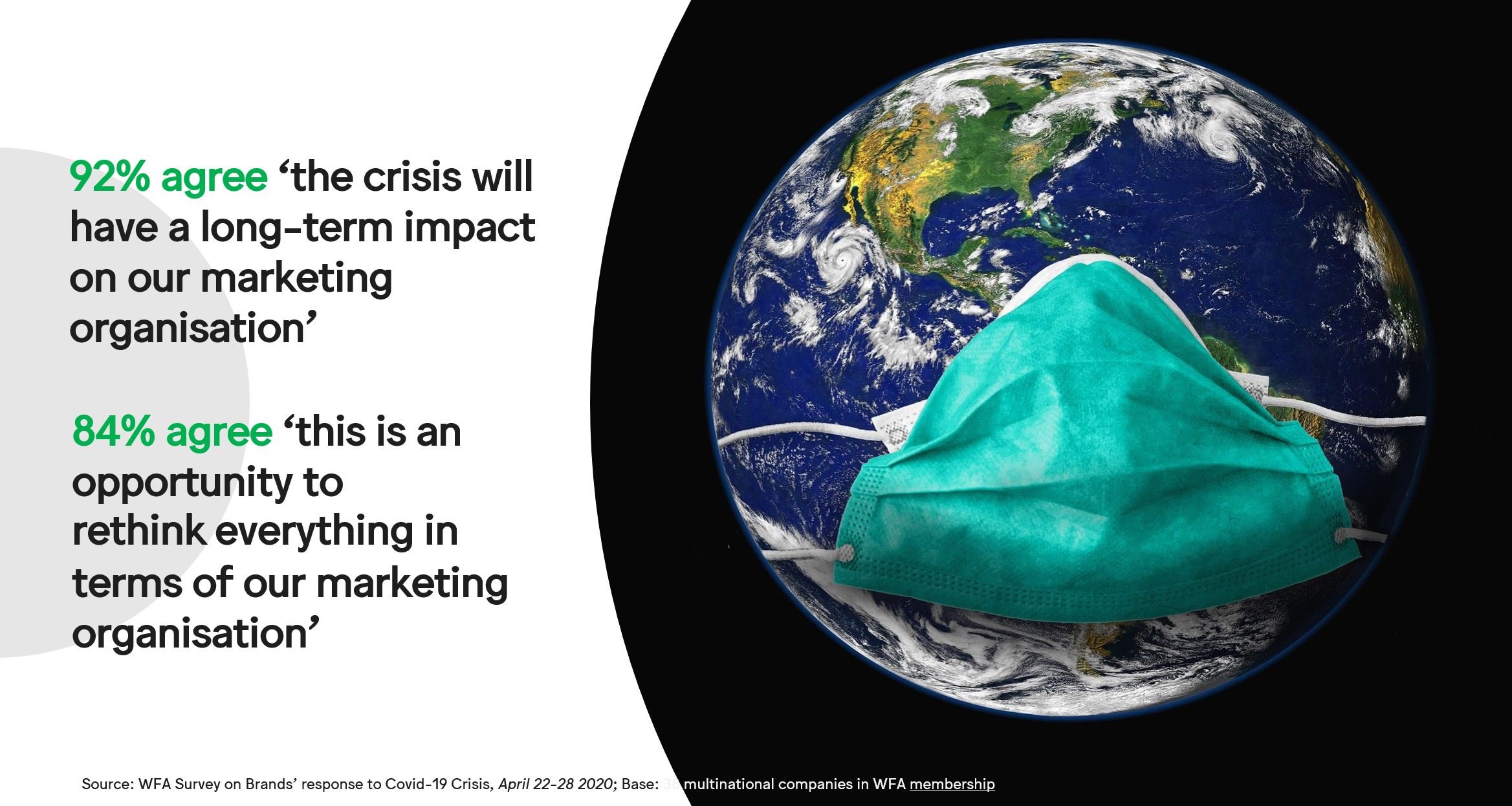

Ninety-two per cent agree that this crisis will have a long-term impact on the way they operate and 84% agree that this is an opportunity to ‘rethink everything in terms of our marketing organisation’, with the same number saying it has already accelerated digital transformation.

Nearly two-thirds (63%) are now focusing on developing strategies for the immediate post-crisis as well as for the longer term but in the interim 73% agree they will have to find ways to support agencies during the crisis.

“Marketing leaders are fully aware that the crisis is having a major impact on their teams and their external partners. Many are making significant efforts to support their agencies by finding projects for their key people to work on while spend is low or by changing their payment terms when they can. Our research shows that such efforts are widespread and reflect how much brands value the contributions that agencies can make to their businesses,” said Stephan Loerke, WFA CEO.

The full report including the complete survey results can be found here.