Get analysis, insight & opinions from the world's top marketers.

Sign up to our newsletter.

The focus for transparency in WFA discussions in recent years has turned to the client/agency relationship, and has been principally concerned with the financial aspects of this relationship.

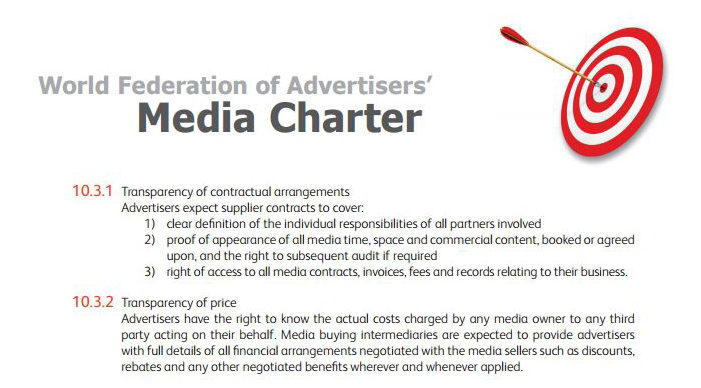

In recognition of the issues surrounding financial transparency and the growing concerns focused on the prevalence of global media rebates, WFA set out a ‘Media Charter’ with a view to stating the principles and objectives that global advertisers sought from their relationships with the media and media agencies.

In this document, we state that agency remuneration paid by advertisers should be the only source of revenue for the work delivered on the business, and that “advertisers seek confirmation of this through complete financial transparency, and expect agencies to fully declare the revenue stream directly or indirectly related to their business, for example via commissions, cash rebates or free advertising”.

The focus for transparency in WFA discussions in recent years has turned to the client/agency relationship, and has been principally concerned with the financial aspects of this relationship.

In recognition of the issues surrounding financial transparency and the growing concerns focused on the prevalence of global media rebates, WFA set out a ‘Media Charter’ with a view to stating the principles and objectives that global advertisers sought from their relationships with the media and media agencies.

In this document, we state that agency remuneration paid by advertisers should be the only source of revenue for the work delivered on the business, and that “advertisers seek confirmation of this through complete financial transparency, and expect agencies to fully declare the revenue stream directly or indirectly related to their business, for example via commissions, cash rebates or free advertising”. Then as now, WFA has not been against rebates and AVBs in and of themselves. But we believe that advertisers should receive a fair share of these and, crucially, that rebates should not create conflicts of interest.

To guide our members we’ve embarked on a number of projects to help shed some light on where (in the world) the transparency problem is most prevalent and what clients can do to protect themselves.

Included among these is our guide to obtaining transparency & return of media income. At the time of writing, we found 21 ways through which agencies receive income from media vendors worldwide based upon client volume expenditure. We recommend that these are added to contracts to ensure receipt of a fair share of these revenues.

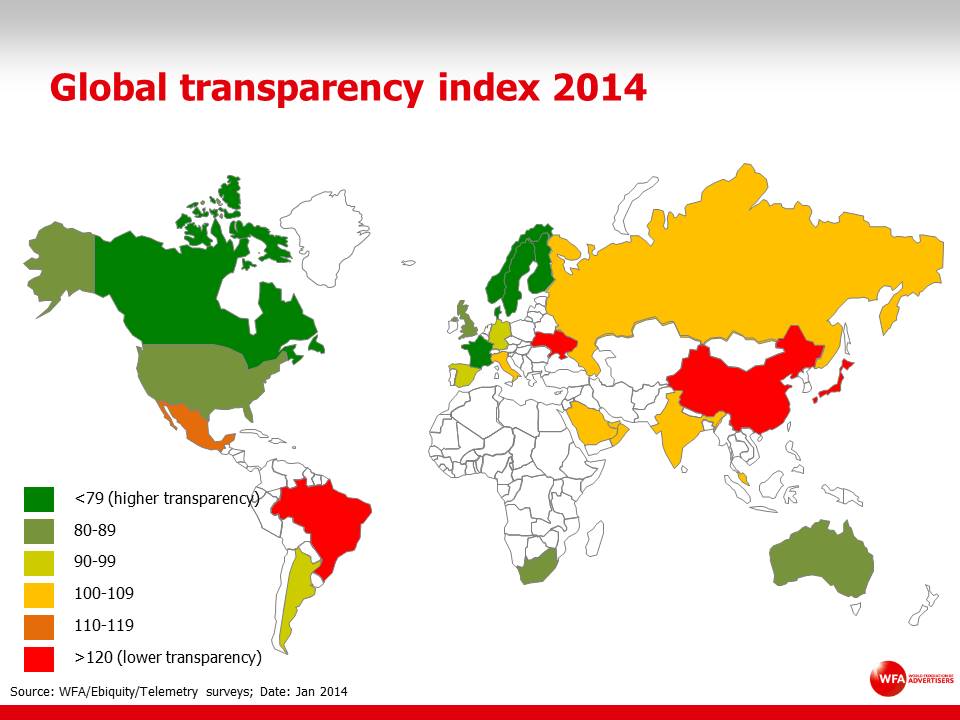

Then there’s our Transparency Index, a joint project with Ebiquity and Telemetry, which identifies countries which have lower levels of media market transparency based upon 16 factors. Included among the 16 are some of the ‘classic’ transparency concerns we’ve been focused on since our foundation in 1953, including level of rebates and level of agency income derived from media owners. But also included are some of the transparency issues which have emerged in force in the past few years, such as the level of visibility into the digital supply chain and advertiser money flows, and the extent of ‘arbitrage’ among agency trading desks.

Then as now, WFA has not been against rebates and AVBs in and of themselves. But we believe that advertisers should receive a fair share of these and, crucially, that rebates should not create conflicts of interest.

To guide our members we’ve embarked on a number of projects to help shed some light on where (in the world) the transparency problem is most prevalent and what clients can do to protect themselves.

Included among these is our guide to obtaining transparency & return of media income. At the time of writing, we found 21 ways through which agencies receive income from media vendors worldwide based upon client volume expenditure. We recommend that these are added to contracts to ensure receipt of a fair share of these revenues.

Then there’s our Transparency Index, a joint project with Ebiquity and Telemetry, which identifies countries which have lower levels of media market transparency based upon 16 factors. Included among the 16 are some of the ‘classic’ transparency concerns we’ve been focused on since our foundation in 1953, including level of rebates and level of agency income derived from media owners. But also included are some of the transparency issues which have emerged in force in the past few years, such as the level of visibility into the digital supply chain and advertiser money flows, and the extent of ‘arbitrage’ among agency trading desks.

China emerged from the index as the market suffering from the lowest levels of transparency with widespread rebates and a deeply complex market characterised by layers of intermediaries and brokers.

Transparency issues have become institutionalised in a number of markets, for better or worse, and France has the opposite problem to China. The Loi Sapin prevents agencies from receiving any rebates from media vendors, including earning discounts based on total client volume. The French advertiser association (UDA) is nowaiming to have this law extended to the digital ecosystem, from which it has so far been exempt.

In recognition of the shifting focus of transparency concerns we are now paying much more attention to digital. Last year we produced a Guide to Programmatic Media, mandated and authored by a task force of several members, including The Coca-Cola Company, Johnson & Johnson, MasterCard, Philips, Boehringer Ingelheim, Deutsche Telekom and GSK.

This guide outlines the models and ways of working where clients can expect greater transparency and control. We found that around 60% of programmatic media budgets were being spent on intermediaries, leaving just 40% as so called ‘working media’. The issue is not having multiple intermediaries involved in media transactions; this is something we need to get used to. But greater opacity and ‘arbitrage’ is not.

We will continue to champion improved visibility for members and will support the work conducted by the ANA. But the opening up of a new transparency front, in the form of ad fraud, suggests that the storm is set to rage for a while yet.

China emerged from the index as the market suffering from the lowest levels of transparency with widespread rebates and a deeply complex market characterised by layers of intermediaries and brokers.

Transparency issues have become institutionalised in a number of markets, for better or worse, and France has the opposite problem to China. The Loi Sapin prevents agencies from receiving any rebates from media vendors, including earning discounts based on total client volume. The French advertiser association (UDA) is nowaiming to have this law extended to the digital ecosystem, from which it has so far been exempt.

In recognition of the shifting focus of transparency concerns we are now paying much more attention to digital. Last year we produced a Guide to Programmatic Media, mandated and authored by a task force of several members, including The Coca-Cola Company, Johnson & Johnson, MasterCard, Philips, Boehringer Ingelheim, Deutsche Telekom and GSK.

This guide outlines the models and ways of working where clients can expect greater transparency and control. We found that around 60% of programmatic media budgets were being spent on intermediaries, leaving just 40% as so called ‘working media’. The issue is not having multiple intermediaries involved in media transactions; this is something we need to get used to. But greater opacity and ‘arbitrage’ is not.

We will continue to champion improved visibility for members and will support the work conducted by the ANA. But the opening up of a new transparency front, in the form of ad fraud, suggests that the storm is set to rage for a while yet.