Get analysis, insight & opinions from the world's top marketers.

Sign up to our newsletter.

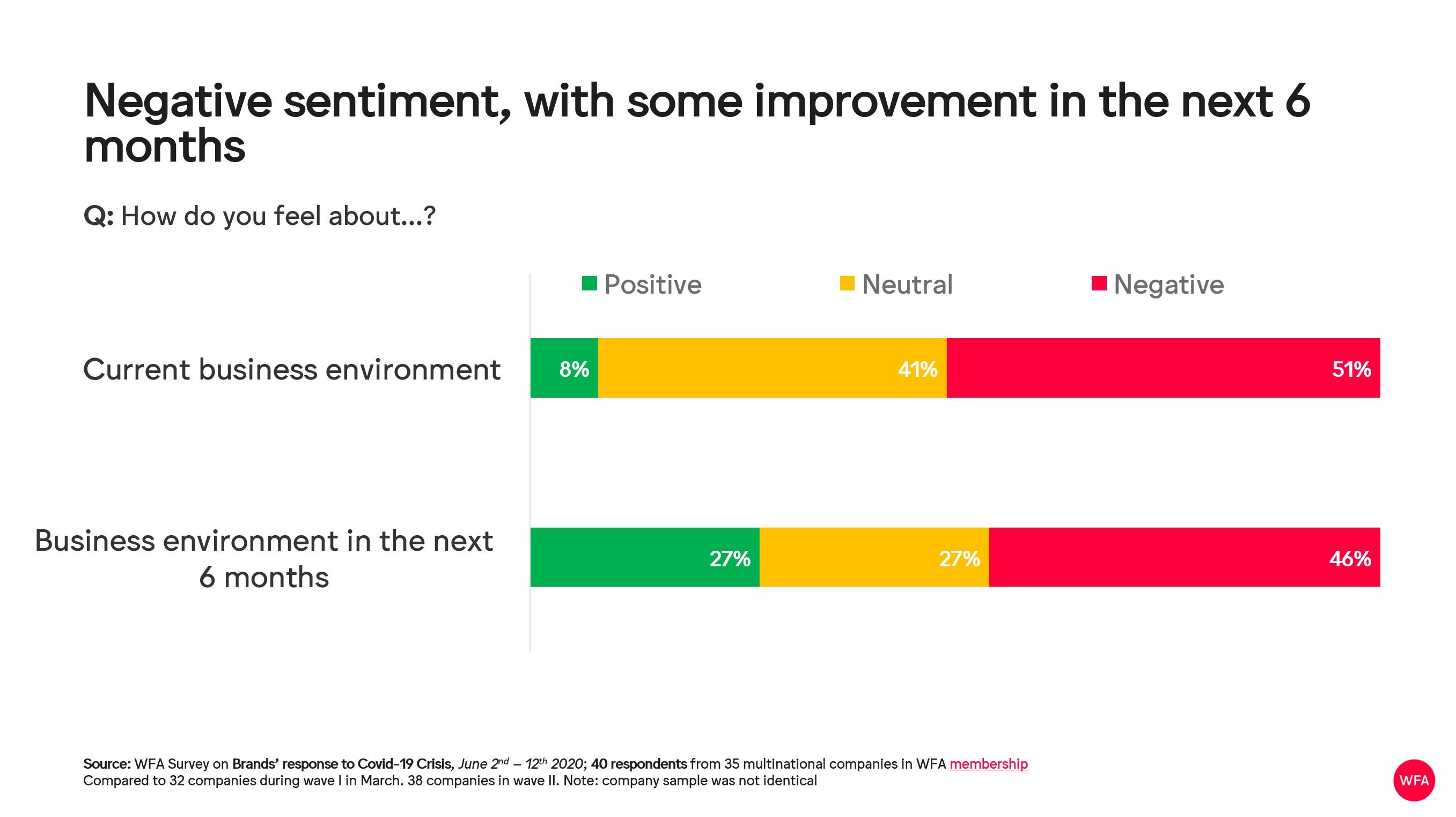

Some optimism as more than a quarter feel positive about the business environment for the next six months

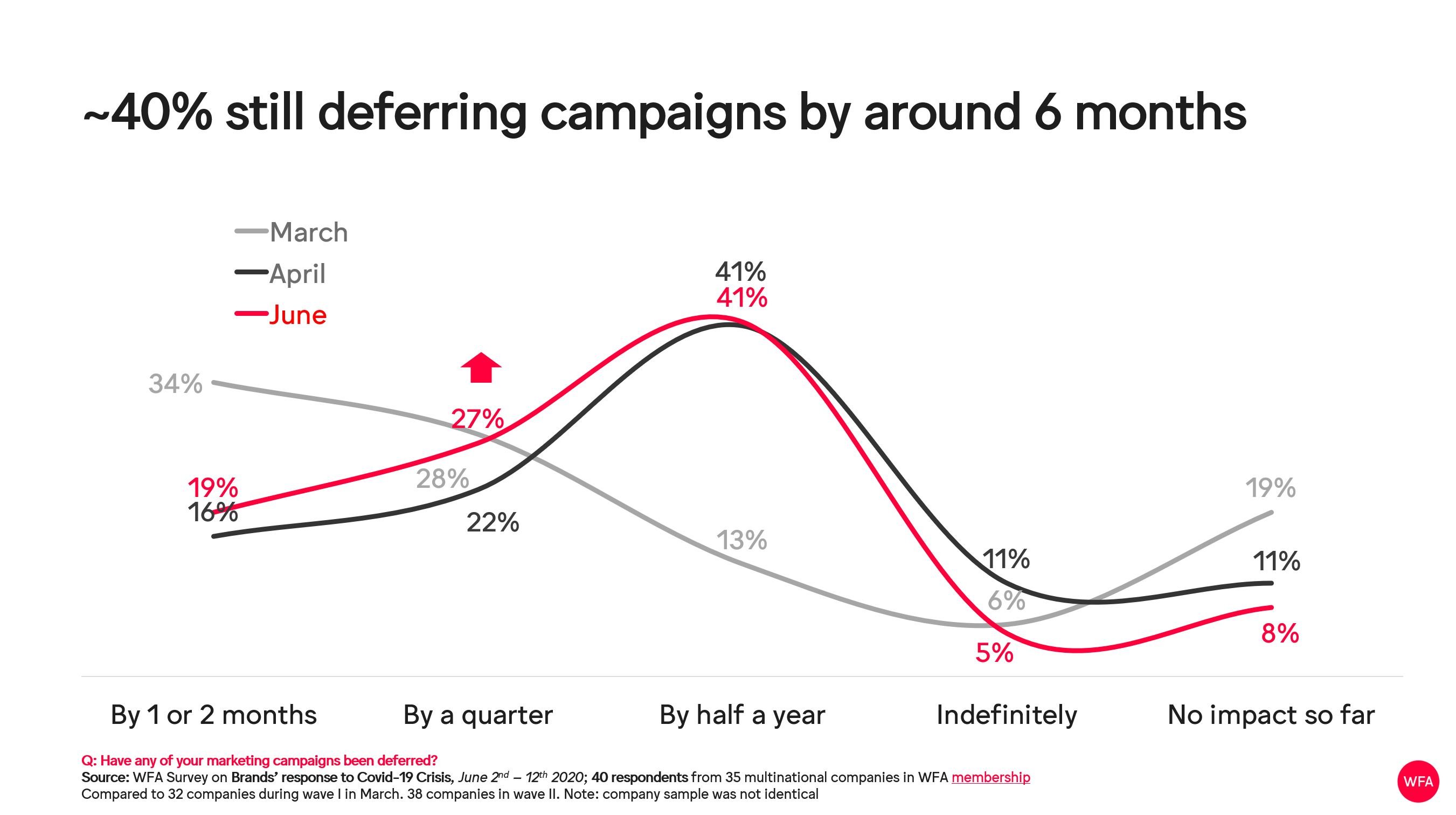

Major multinationals are continuing to hold back advertising spend by six months with more than 40% deferring campaign spend according to WFA’s Covid-19 Response Tracker.

That’s the same level of deferral as the WFA’s previous data released in May, reflecting the fact that the world’s largest companies continue to be wary of returning to the old normal, even as lockdown restrictions are lifted in many countries.

The vast majority (78%), however, do now have response campaigns live up from just 32% in March when the WFA conducted its first Covid-19 Response Tracker research. While such campaigns do stop brands from going “dark” during the crisis they also tend to involve smaller advertising investments than what was originally planned at the start of the year.

The results for Wave III of the Covid-19 Response Tracker are based on responses from 35 major advertisers across more than eight key sectors with a cumulative total annual ad spend of $65bn.

The survey will disappoint those looking for a quick bounceback in ad spend as markets start to open up. Wave II of the WFA’s Covid-19 Tracker found that large multinationals expect 2020 ad spend would be down by 36% globally.

Nevertheless, there is some improvement in sentiment among senior marketers at large multinationals. While just 8% feel positive about the current business environment, 27% are positive about the business environment in the next six months. Around half however feel negative on both time frames with 51% not positive about the current business environment and 46% expressing the same sentiment on the six-month timeframe.

In the midst of the current restrictions, most respondents are trying to maintain business as normal with their agency partners. More than half (53%) have updated Scope of Work agreements with their agencies to allow work to be done remotely and the same number have continued to run planned pitches.

“While the overall picture may show continued restraint when it comes to global ad spend, anecdotal evidence from our conversations with CMOs shows that major multinationals are seeing business growth in China and more broadly across APAC. We are also hearing about rises in ad spend globally in some key sectors. We expect advertisers to remain cautious but many are preparing plans for recovery. A more tactical approach, where opportunities for more flexible, short-term buying become available, is likely to be key to building confidence for a return to higher levels of advertising investment,” said Stephan Loerke, CEO of the WFA.

WFA members can download the survey results here.