UK programmatic audit suggests improvements in online advertising transparency

Clare O'Brien, ISBA's Head of Media, Performance & Effectiveness, shares on the ins and outs of the second iteration of their Programatic Supply Chain Transparency Study

Share this post

In January 2023, ISBA and PwC published the top line findings from their 2nd Programmatic Supply Chain Transparency Study, which showed good progress from the one conducted in 2020. Critically, it demonstrates that spend in the programmatic ecosystem – complex as it is – can be accountable.

It is also part of an ongoing story to align programmatic media buying with other channels, not least because of its growth trajectory. In 2021 global programmatic advertising spend was $173.13bn according to researchandmarkets.com, forecast to grow at a CAGR of 30.3% to $649.63bn by 2027. This kind of investment is only sustainable when advertisers have transparent oversight of their supply chain data. This requires widescale cultural change across the ecosystem with financial audits a routine market feature.

When the first ISBA Programmatic Supply Chain Transparency Study, was published in Summer 2020, its results shook the industry – both buy and sell side – around the world. Most memorably, it was the 15% unattributable spend, or ‘unknown delta’, which drove the story.

However, the starker headline number for ISBA’s participating advertisers was 12%. That’s the number of impressions that PwC was able to match, end-to-end, of the total 267 million impressions identified between the participating 15 advertisers and 12 publishers (31 million).

The other way to think about it is that 88% of known impressions (235 million) could not be accurately matched. This was because the data was of poor quality; in aggregate and not log file format, missing or unavailable, lost due to contractual issues or simply refused.

In the 2023 study, that match rate rose to 58%, as a result of the improvements made by some of the ad tech industry’s leading players responding to the untenable results of the first study and the collaboration of UK’s Cross-industry Programmatic Taskforce.

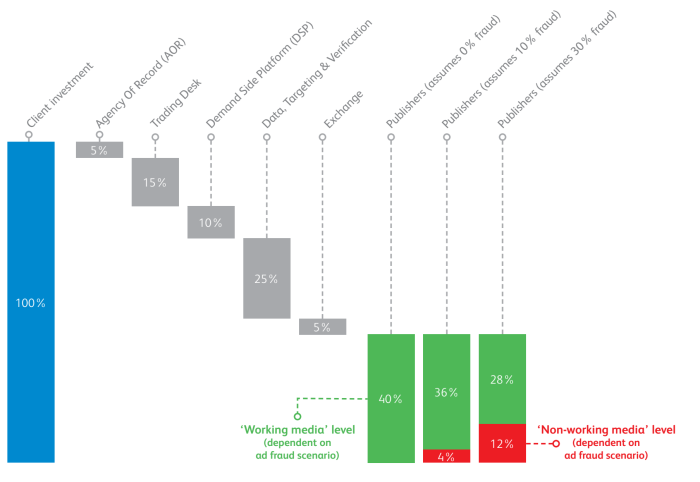

It is clear that despite two earlier ground-breaking investigations into the programmatic supply chain exposing the high cost of the programmatic ecosystem - the WFA’s Waterfall Report (2014) and the ANA’s Programmatic: Seeing Through the Financial Fog (2017) which both illustrated the scale of the problem, the ad tech industry had made little or no improvements when it came to transparency of the online supply chain.

Source: 2014 WFA Compendium of ad fraud for media investors, based on industry data

By bringing in publisher data, with the collaboration of the UK’s Association of Online Publishers (AOP), ISBA was able to ask PwC to carry out an end-to-end study, building on the work of the ANA and WFA.

Once the study was published, ISBA called its industry stakeholder colleagues together to form the UK Cross-industry Programmatic Taskforce, to jointly address PwC’s findings and issued two key recommendations:

- to investigate the 15% unattributable spend;

- by examining data quality and access to it, both of which, PwC felt were the cause of the unacceptable match rates.

This taskforce was made up of the UK trade bodies and their practitioner members for each of the stakeholder groups: ISBA for advertisers, the Association of Online Publishers (AOP), agencies represented by the Institute of Practitioners of Advertising (IPA) and IAB UK and IAB TechLab representing ad tech vendors.

It was the first time these stakeholder groups had worked together to address transparency in the supply chain and it led to an excellent level of collaboration. More than 45 organisations joined calls every three weeks for 18 months to address the two core issues that were at the heart of the problem: data quality and access to it by nominated third party auditors.

The taskforce’s primary output was the Programmatic Financial Audit Toolkit, comprising an agreed list of required data fields to support accurate impression matching and an Audit Permission Letter (APL), a kind of universal NDA the industry could recognise, together with an agreed set of principles of operation.

The toolkit was published in February 2022 and ISBA, its members, AOP and PwC agreed to test it in market conditions. Anecdotally, we were aware that many vendors had been making improvements in terms of availability of log file data, more collaborative behaviours between DSPs and SSPs and some waiving of permission requirements at global level. It was clear, that the cultural and technical responses to that study were beginning to impact at the top levels of the ecosystem.

The results of this 2022 study, which eventually went into field in September and October 2022, highlighted this shift at the top.

And for this the taskforce should take full credit. Changes are being implemented because all parties recognise the benefit of being able to see where the money goes: publisher revenues improve, advertiser investment is more secure and transparent, vendors are more likely to benefit as advertisers take charge of their own supply chains.

Success can be measured by a five-fold increase in match rate (58% vs 12%), publisher revenue increasing from 51% to 65% and a completion time of nine rather than 18 months (although it should take around 4 months to complete).

Notably the unattributable spend also came in at 3%, down from 15%. Yet to this point it is still critical to point out that the PwC team of data scientists carrying out the study had to show considerable persistence with the ad tech vendors to ensure the necessary quality of data was obtained. In one case, the correct data was delivered only after five attempts and with a great deal of handholding. Without correct, quality data, that figure would still have been in double figures. Not a realistic scenario for routine audits. The right to audit is an inclusive ambition for all advertisers, not only those with the means and capacity for such sophisticated interventions.

This is why the taskforce is once again meeting to take forward the learnings from the second study and make refinements to the Toolkit and to look to refine further recommended protocols and standards.

Advertisers are the key to continued wholesale cultural change; Embed the requirement for routine audits in your media contracts; normalise the ambition; work with vendors that accept the APL and reject those that don’t; make it clear that transparency is a key requisite to doing business.

We are still some distance from normalising audits and achieving a genuinely transparent programmatic supply chain. Advertisers need to keep pushing for it.

In the US, the ANA’s investigation into the programmatic market is expected to publish this Spring. More extensive than simply following the money as the UK work has done, the US study is wider, deeper and qualitative as well as quantitative.

There is potential for work in other markets as well and, at ISBA, we welcome every step forward that reinforces the message that advertisers will always seek to work with the most transparent players.